Net Sales Includes Which of the Following Computations:

Example of Net Sales. Net sales is computed by deducting the sales discounts sales returns and allowances to the amount of sales revenue for the.

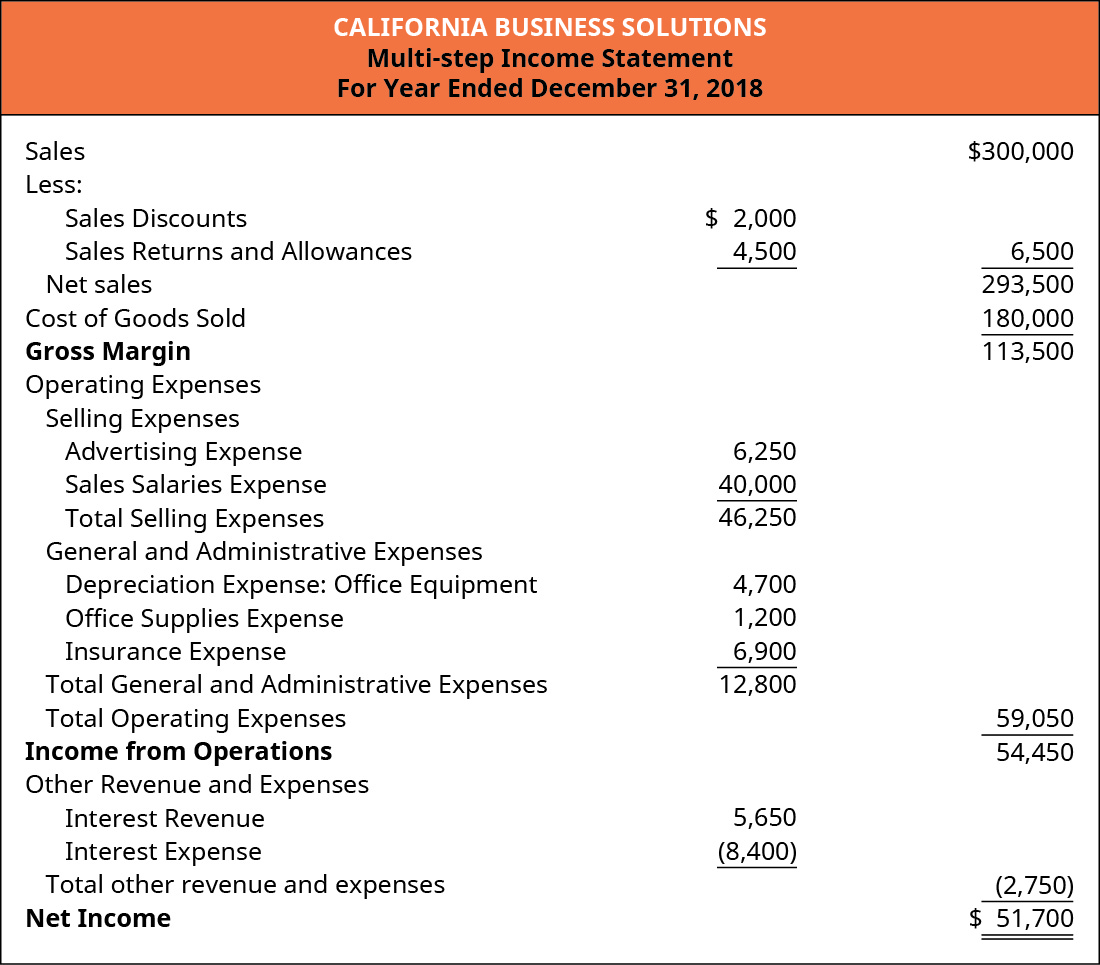

Describe And Prepare Multi Step And Simple Income Statements For Merchandising Companies Principles Of Accounting Volume 1 Financial Accounting

Which of the following computations would be used to compute Net Revenue.

. Which of the following computations will cause an overflow. Net Sales Gross Sales - Sales Returns and Allowances. It is important for managers to be able to correctly calculate the volume of net sales.

The debtors Debtors A debtor is a borrower who is liable to pay a certain sum to a credit supplier such as a bank credit card company or goods supplier. Gross Sales is equal to the total of all sales receipts before discounts returns and allowances. That is the number of units sold multiplied by the price per unit.

Net sales is the result of gross sales minus returns allowances and discounts. Minus sales minus sales discounts plus sales returns and allowances plus sales discounts minus sales returns and allowances plus sales. Net income formula.

Sales Revenue Cost of Goods Sold Gross Profit 96000 49000 145000 c. Electrical Engineering questions and answers. The cost to retail ratio for the average retail method is the cost of beginning inventory and purchases divided by the retail value of these two amounts plus net additional markups less net markdowns.

The borrower could be an individual like a home loan seeker or a corporate body. By using the net sales formula companies get a better idea of how they perform as well as their overall financial health. Net sales is the total revenue less cost of sales return allowances and discounts.

For example if a company has gross sales of 100000 sales returns of 5000 sales allowances of 3000 and discounts of 2000 the net sales are calculated like this. Purchase returns reduce net purchases at both cost and retail because returns represent amounts included in gross purchases that are not available for sale. Net income is your companys total profits after deducting all business expenses.

Using these parts here is the net sales formula. C 1001100110111011 O D. Net sales is what remains after all returns allowances and sales discounts have been subtracted from gross sales.

1000000 Gross sales - 10000 Sales returns - 5000 Sales Allowances - 15000 Discounts 970000 Net sales. Why use the net sales formula. Total Revenue Accounts Receivable - Sales Discounts - Sales Allowances Net Revenue Sales Allowances - Sales Discounts Total Revenue - Sales Discounts - Sales Allowances Net Income - Change in Accounts Receivable.

Therefore net sales include only the amount received from the sale after deducting all the costs listed above. The multiple-step income statement normally includes which of the following. Electrical Calculators Real Estate Calculators Accounting Calculators Business Calculators Construction Calculators Sports Calculators Random Generators.

If a Product is sold in a package or kit containing another product which is not a Product the Net Sales price for purposes of calculating the royalty under Section 32 hereof shall be calculated by multiplying the Net Sales Price of the combination product by the fraction of AAB where A is the Net Sales Price of Product when sold separately B is the Net Sales Price of the other. Net sales are equal to gross sales less sales return less allowances less discounts. The numbers are in 8-bit twos complement form O A O B.

A credits allowances discounts rebates and chargebacks provided to a Third Party. 100000 Gross Sales - 5000 Sales Returns - 3000 Sales Allowances -. Read more of the firm after accounting for any sales return discounts allowances.

There may be times when certain addition of additional debt through net credit sales may create collection problems for a firm. Following is the net sales formula on how to calculate net sales. B freight postage transportation and insurance costs incurred in delivering Licensed.

Net sales gross sales returns allowances discounts. The formula of net sales in accounting calculates the Net Revenue Net Revenue Net revenue refers to a companys sales realization acquired after deducting all the directly related selling expenses such as discount return and other such costs from the gross sales revenue it generated. If net sales are externally reported they will be notated in the direct costs portion of.

For example if a company has gross sales of 1000000 sales returns of 10000 sales allowances of 5000 and discounts of 15000 then its net sales are calculated as follows. What Are the Differences. See full answer below.

Ending Inventory Beginning Inventor View the full answer. Receivable turnover ratio Net sales Average accounts receivable net Receivable turnover ratio Net sales Average accounts receivable net Correct Explanation Knowledge Check 01 Asset turnover ratio Net sales Average total assets Inventory turnover ratio Cost of goods sold Average inventory. Conducting a competent analysis of the net sales will allow you to clearly see trends in the positive or conversely negative sales dynamics.

Detailed computations of net sales. Net sales includes which of the following computations. Cost of Goods Sold Sales revenue - Gross Profit 109000 - 43000 66000 b.

Some people refer to net income as net earnings net profit or simply your bottom line nicknamed from its location at the bottom of the income statementIts the amount of money you have left to pay shareholders invest in new projects or equipment pay off debts. Net Sales means the gross invoiced price of Licensed Products sold to a Third Party other than a Sublicensee unless such Sublicensee is the end user of such Licensed Products less the following.

How I Filed My Own Itr For The 1st Time One Day Kaye Income Tax Return Filing Taxes Tax Return

Shopify Intro To Cash Flow Management And Forecasting Free Projection B21ce514 Resumesample Res Income Statement Profit And Loss Statement Statement Template

Pin By Ep C On Aac Apps Augmentative Communication Autism Communication Apps For Teachers

What Is A Cash Flow Statement Definition And Explanation Cash Flow Statement Bookkeeping Business Cash Flow

Manual Testing Vs Automated Testing Vs Integrated Approach Manual Testing Automation Software Testing

Intel S 8th Gen Core With Radeon Rx Vega M May Make Nvidia Worry Digital Trends Computer Technology Intel Core

Components Of The Income Statement Accountingcoach

Sales Revenue Formula Calculate Grow Total Revenue

Components Of The Income Statement Accountingcoach

Manual Testing Vs Automated Testing Vs Integrated Approach Manual Testing Automation Software Testing

Components Of The Income Statement Accountingcoach

Bi Fold Software Product Brochure Template Ad Sponsored Software Fold Bi Template Brochure Brochure Template Brochure Templates

Small Business Operations Manual Template New Roadmap Project Throughout Small Business Operations Manual Project Manager Resume Resume Examples Resume Skills

Construction Accountant Job Ad Description Template Google Docs Word Apple Pages Template Net Accounting Jobs Job Ads Job Description Template

Resignation Checklist Template Google Docs Word Template Net In 2022 Checklist Template Resignation Letter Resignation

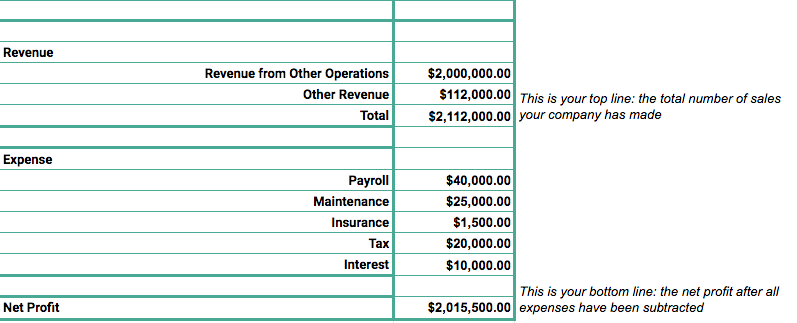

Simple Profit And Loss Statement Income Statement Profit And Loss Statement Balance Sheet Template

Comments

Post a Comment